Business

Empowering Your Financial Journey: The Essential Role of Accounts Checking

As we navigate personal finance’s complexities, the humble checking account stands out. It is a powerful tool for achieving financial empowerment. In the digital finance age, mastering your money is the first step. It begins with improving your checking account. Utilizing its full potential streamlines daily transactions. You will also monitor your spending and find growth opportunities.

Maximizing the Potential of Your Checking Account

Streamlining Daily Transactions

Your checking account serves as the central hub for everyday financial activities. It facilitates direct deposits from your employer, enabling seamless income management. It also simplifies bill payments and debit card transactions. This ensures you can meet your financial obligations easily. According to a recent study, over 90% of Americans rely on checking accounts for managing their daily financial needs.

In Idaho, many credit unions offer good checking accounts. They have features like e-statements and dividends (interest earned on your balance). These features make credit unions a popular choice for both personal and business checking accounts.

Financial Monitoring and Budgeting

Beyond facilitating transactions, checking accounts have evolved into powerful budgeting tools. Online banking and mobile apps give real-time insights into your spending. They let you track expenses, set budgets, and get alerts when you are nearing your limits. This proactive approach empowers you. It lets you stay in control of your finances. You can make informed choices about your spending habits.

For Idaho residents seeking a no-fee checking account option, Pioneer Federal Credit Union offers a no fee checking account that allows you to manage your finances without the burden of monthly maintenance charges.

The Strategic Use of Checking Accounts in Financial Planning

Checking accounts streamlines daily transactions. Their real power is unleashed when you integrate them into your financial planning. By understanding and using their full potential, you can protect your finances. You can also pave the way for long-term growth.

Emergency Funds and Overdraft Protection

Unexpected expenses can derail even the most well-planned financial journeys. That’s why maintaining an emergency fund is crucial. Your checking account can serve as a buffer. It offers overdraft protection and a line of credit to cover unexpected costs. A study by the Federal Reserve found that households with access to overdraft protection are better prepared. They can handle financial shocks.

Interest-Earning Potential

Not all checking accounts earn interest. However, many banks offer high-yield options. These let you earn interest on your deposited funds. Over time, this can significantly contribute to your wealth accumulation.

In Idaho, many credit unions and banks offer dividend-earning checking accounts. They let you earn interest on your balance while using a checking account.

Leveraging Technology for Enhanced Checking Account Benefits

As we harness our checking accounts for foundational financial planning, leveraging technology opens new avenues for enhancing their benefits. It offers innovative solutions to automate savings. It also offers solutions to make security stronger. The digital landscape does this to streamline your financial journey.

Automated Savings and Investments

Many checking accounts now have tools. They move some of your paycheck or recurring income into savings or investment accounts. This “set-it-and-forget-it” approach enables effortless wealth growth, aligning with the principle of “paying yourself first.” A recent study found that people who automate their savings reach their financial goals at a higher rate.

Security Features and Fraud Prevention

In the digital age, the security of your finances is paramount. Leading banks have added strong security measures. These include two-factor authentication and real-time fraud alerts. They protect your checking account from unauthorized access and suspicious activity. These measures provide peace of mind, protecting your hard-earned money against potential threats.

Understanding Fees and How to Avoid Them

While checking accounts offer numerous benefits, it’s essential to be aware of the potential fees associated with them. By understanding these charges and employing effective strategies, you can maximize the value of your account and avoid unnecessary expenses.

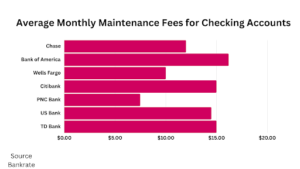

Common Fees Associated With Checking Accounts

Some of the most common fees include monthly maintenance charges, ATM usage fees (especially for out-of-network transactions), and overdraft fees. These costs can quickly accumulate, eroding your hard-earned savings if left unchecked. Bankrate did a study. They found that the average monthly fee for a non-interest checking account is about $5.08.

In Idaho, many local credit unions and community banks offer checking accounts with low or no monthly fees. They are an attractive option for both personal and business checking.

Negotiating Terms with Banks

Contrary to popular belief, many fees associated with checking accounts are negotiable. By maintaining a positive relationship with your bank and demonstrating loyalty, you may be able to secure waivers or reduced rates for certain fees.

The Future of Checking Accounts: Trends and Innovations

As we become adept at managing and minimizing fees, it’s crucial to look ahead at the evolving landscape of checking accounts. Digital banking and fintech innovations are reshaping how we interact with our finances. They offer new opportunities for more convenience and access.

Digital Banks and Fintech Innovations

Traditional brick-and-mortar banks face disruption from digital-first institutions and fintech companies. These innovative players are redefining the checking account experience. These institutions offer fee-free accounts, easy account opening, and seamless integration with other financial tools. A report by McKinsey & Company says digital banking adoption has surged. Over 73% of customers now use digital channels for their financial needs.

Integration with Payment Platforms and Digital Wallets

Today’s connected world is integrating checking accounts with popular payment platforms and digital wallets. These include Apple Pay, Google Pay, and PayPal. This convergence allows for smooth financial transactions. It lets you make purchases, move funds, and manage your finances from one platform.

Comparison Table: Checking Account Features Across Major Banks

To help you make an informed decision, we’ve compiled a comprehensive comparison table highlighting the key features of checking accounts offered by some of the largest banks in the United States:

| Bank | Interest Rate (APY) | Overdraft Protection | Mobile App | Automated Savings |

| Chase | 0.01% | Available | Yes | Yes |

| Bank of America | 0.02% | Available | Yes | Yes |

| Wells Fargo | 0.01% | Available | Yes | No |

| Citibank | 0.03% | Available | Yes | Yes |

| PNC Bank | 0.01% | Available | Yes | No |

Please note that fees, interest rates, and other account details are subject to change, and it’s essential to verify the information with each bank before opening an account.

Frequently Asked Questions

1. How does the type of checking account affect my financial health?

The type of checking account you choose can significantly impact your financial well-being. For instance, interest-bearing accounts can grow your money. And, accounts with low or no fees can maximize your savings. Also, accounts with overdraft protection and other features can provide a safety net. They help during financial emergencies. They prevent expensive overdraft charges and potential hits to your credit score.

2. Can a checking account improve my credit score?

Checking accounts are not reported to credit bureaus. But, managing your account well can indirectly affect your credit score. Avoiding overdrafts helps. So does keeping a positive balance. And so does showing consistent financial behavior. These things make for a good credit profile. Also, some banks may report mishandled accounts or unpaid fees to credit agencies. This action could impact your credit score.

3. What are the key factors to consider when switching to a digital or online-only checking account?

When transitioning to a digital or online-only checking account, it’s essential to consider factors such as accessibility, fees, security, and customer service. Make sure the bank offers an easy-to-use mobile app and online banking. Also, make sure it has strong security. This includes two-factor authentication and fraud monitoring. Also, check if there are physical branches or ATMs nearby. And, check the quality of customer support, in case you need help with your account.

Conclusion

Unlocking your checking account’s full potential is a powerful step. It helps in achieving financial empowerment. You can transform your checking account into a strategic tool. You can do this by knowing the benefits. You can use tech and stay informed about fees and trends. It will help manage daily transactions. It will also help build an emergency fund and grow your wealth.

Take the time to review your current checking account and assess whether it aligns with your financial goals and needs. If not, explore the choices of many banks and fintech providers. Don’t hesitate to negotiate fees or seek out accounts with better terms.

Remember, financial empowerment is a journey. Your checking account is the foundation for building a secure and prosperous future. Embrace the opportunities it presents, and take control of your financial destiny today.

Business

Coomersu: The New Era of Commerce and User Engagement

Introduction

In today’s fast-paced and ever-evolving global marketplace, businesses are constantly on the lookout for innovative strategies to stay ahead of the competition. One such groundbreaking concept that has emerged is Coomersu—a dynamic fusion of commerce and user engagement that is reshaping the way companies interact with their customers. This article will explore the essence of Coomersu, its significance, applications, and the myriad benefits it offers in the contemporary business landscape.

What is Coomersu?

Coomersu is a portmanteau of “commerce” and “user,” reflecting a revolutionary approach that emphasizes the integration of user-centric strategies within commercial enterprises. Unlike traditional commerce models that focus primarily on transactions, Coomersu is centered around building robust relationships with customers. It involves creating memorable experiences, fostering loyalty, and driving meaningful interactions.

The Evolution of Commerce

Historical Context of Commerce

Commerce has come a long way from its rudimentary beginnings in bartering and simple trade. Over centuries, it has evolved through various stages—from local marketplaces to global e-commerce platforms. Traditional commerce was heavily transaction-focused, prioritizing the exchange of goods and services over customer experience.

How User Engagement Has Changed Over Time

As technology advanced and consumer expectations grew, businesses began to recognize the importance of engaging with users on a deeper level. The rise of digital platforms and social media has transformed how companies connect with their audience. Today, user engagement is not just about providing a service or product; it’s about creating a holistic experience that resonates with customers on an emotional and personal level.

Key Principles of Coomersu

User-Centric Strategies

At the heart of Coomersu is the principle of user-centricity. This approach involves tailoring strategies to meet the unique needs and preferences of customers. It goes beyond mere customer service to encompass a deeper understanding of user behavior, preferences, and feedback.

Building Relationships vs. Transactions

While traditional commerce focuses on completing transactions, Coomersu prioritizes building lasting relationships with customers. This shift from a transactional to a relational mindset helps businesses create a loyal customer base and drive repeat business.

Creating Memorable Experiences

Coomersu emphasizes the creation of memorable experiences that leave a lasting impression on customers. Whether through personalized interactions, exceptional service, or engaging content, the goal is to make every customer touchpoint meaningful and impactful.

The Benefits of Coomersu

Enhanced Customer Loyalty

One of the primary benefits of adopting Coomersu strategies is the enhancement of customer loyalty. By focusing on user engagement and relationship-building, businesses can foster a sense of loyalty among their customers, leading to higher retention rates and long-term success.

Improved Customer Satisfaction

Coomersu also leads to improved customer satisfaction. When customers feel valued and understood, they are more likely to have positive experiences and provide favorable feedback. This, in turn, enhances the overall reputation of the business.

Increased Brand Advocacy

Satisfied and loyal customers often become brand advocates, promoting the business through word-of-mouth and social media. Coomersu strategies help cultivate this advocacy by ensuring that customers have exceptional experiences worth sharing.

Applications of Coomersu

E-commerce Platforms

In the realm of e-commerce, Coomersu can be applied through personalized shopping experiences, tailored recommendations, and interactive customer support. E-commerce platforms that leverage Coomersu principles can create more engaging and user-friendly environments.

Retail Experiences

For brick-and-mortar stores, Coomersu involves creating immersive and personalized shopping experiences. This can include interactive displays, personalized service, and loyalty programs that enhance the overall in-store experience.

Digital Marketing Strategies

Coomersu principles can also be integrated into digital marketing strategies. This includes personalized content, targeted advertisements, and interactive campaigns that resonate with users and drive engagement.

Implementing Coomersu in Your Business

Steps to Adopt Coomersu Strategies

Adopting Coomersu strategies involves several key steps. Begin by understanding your target audience and gathering insights into their preferences and behaviors. Next, develop user-centric strategies that align with these insights and integrate them into your business operations.

Tools and Technologies for Effective Implementation

To effectively implement Coomersu, businesses can leverage various tools and technologies, such as customer relationship management (CRM) systems, data analytics platforms, and marketing automation tools. These technologies help streamline user engagement efforts and provide valuable insights into customer interactions.

Challenges in Adopting Coomersu

Potential Obstacles

While the benefits of Coomersu are significant, businesses may encounter challenges in its adoption. These challenges can include resistance to change, resource constraints, and difficulties in implementing new technologies.

Solutions to Overcome These Challenges

To overcome these challenges, businesses should focus on gradual implementation, invest in training and development, and seek expert guidance if needed. Building a culture of user-centricity within the organization can also help address resistance and drive successful adoption.

Case Studies of Coomersu in Action

Successful Examples from Various Industries

Several businesses have successfully adopted Coomersu strategies and reaped the rewards. For example, companies in the retail and e-commerce sectors have seen significant improvements in customer loyalty and satisfaction by implementing personalized and engaging experiences.

Lessons Learned and Best Practices

From these case studies, businesses can learn valuable lessons and identify best practices for implementing Coomersu. Key takeaways include the importance of understanding user needs, leveraging technology effectively, and maintaining a focus on relationship-building.

The Future of Coomersu

Emerging Trends and Innovations

The future of Coomersu is likely to be shaped by emerging trends and innovations. Advances in artificial intelligence, machine learning, and data analytics will further enhance user engagement and personalization capabilities.

Predictions for the Evolution of User-Centric Commerce

As Coomersu continues to evolve, we can expect an increased emphasis on hyper-personalization, seamless omnichannel experiences, and greater integration of user feedback into business strategies.

Conclusion

Coomersu represents a transformative shift in commerce, emphasizing the importance of user engagement and relationship-building. By adopting Coomersu principles, businesses can enhance customer loyalty, improve satisfaction, and drive long-term success. As we move forward, embracing this user-centric approach will be crucial for staying competitive in the ever-changing marketplace.

FAQs

What exactly is Coomer’su?

Coomer’su is a concept that combines commerce with user engagement, focusing on building relationships, creating memorable experiences, and fostering customer loyalty.

How can Coomer’su benefit my business?

Coomer’su can benefit your business by enhancing customer loyalty, improving satisfaction, and increasing brand advocacy through user-centric strategies and personalized interactions.

What are the key challenges in implementing Coomer’su?

Key challenges in implementing Coomer’su include resistance to change, resource constraints, and difficulties in integrating new technologies. Addressing these challenges requires gradual implementation, training, and a focus on user-centricity.

Can small businesses adopt Coomer’su strategies?

Yes, small businesses can adopt Coomer’su strategies by focusing on understanding their customers, leveraging affordable tools and technologies, and implementing user-centric practices within their operations.

What are some real-world examples of Coomer’su?

Real-world examples of Coomer’su include personalized shopping experiences in e-commerce, interactive retail displays, and targeted digital marketing campaigns that engage users and enhance their overall experience.

Business

Is Shein Shutting Down? Latest Updates

Introduction

Shein’s Current Status

Recent headlines have sparked curiosity and concern among Shein’s vast customer base. Despite the buzz, it’s crucial to differentiate between speculation and verified information. As of the latest updates, Shein has not officially announced any plans to shut down. The company continues to operate its online platform and retail activities globally. Statements from Shein’s management indicate that while there are challenges, there is no immediate plan for closure.

Reasons Behind the Speculation

Several factors have fueled the speculation about Shein’s potential shutdown:

- Financial Issues: Shein, like many businesses, faces financial pressures, including rising costs and fluctuating revenues. However, financial challenges are common in the retail sector and do not necessarily indicate an impending shutdown.

- Market Competition: The fashion industry is highly competitive, with numerous brands vying for consumer attention. Shein faces stiff competition from both established and emerging brands, which can contribute to market rumors.

- Supply Chain Challenges: Disruptions in the global supply chain have affected many businesses, including Shein. These disruptions can lead to delays and increased costs, fueling speculation about the company’s stability.

Shein’s Business Model

Shein’s success can be attributed to its innovative business model, which focuses on fast fashion. The company is known for its rapid production cycles and extensive inventory, allowing it to offer the latest trends at competitive prices. Shein’s global reach, with its online presence spanning multiple countries, has cemented its position in the fashion industry. Understanding Shein’s business model provides context for the challenges it faces and the speculations surrounding its future.

Consumer Reactions

Consumers play a vital role in Shein’s brand image and success. The recent rumors of a potential shutdown have led to mixed reactions among Shein’s customers. While some are concerned about losing access to their favorite fashion pieces, others are skeptical of the rumors, viewing them as part of the industry’s natural ups and downs. The impact on consumers also includes potential shifts in shopping habits and brand loyalty.

Industry Experts’ Opinions

Fashion industry experts and analysts offer various perspectives on Shein’s situation. Some believe that Shein’s strong market position and innovative strategies will help it navigate current challenges. Others are cautious, noting that the fashion industry’s volatility can be unpredictable. Expert opinions provide valuable insights into the possible scenarios for Shein’s future, highlighting both opportunities and risks.

Impact on the Fashion Industry

The potential closure of a major player like Shein could have broader implications for the fashion industry. Shein’s departure might affect fast fashion trends, pricing dynamics, and consumer behavior. The industry could see shifts in market share, with other brands potentially filling the void left by Shein. Understanding these potential impacts helps in grasping the broader significance of the current rumors.

What’s Next for Shein?

While the future of Shein remains uncertain, several scenarios could play out. The company might adapt to challenges by restructuring its business model, exploring new markets, or enhancing its supply chain. Monitoring Shein’s strategic moves and official announcements will be crucial in understanding its trajectory. Staying informed about these developments can provide insights into the brand’s future.

How to Stay Informed

To keep up with the latest updates on Shein, it’s essential to rely on credible sources. Follow news from reputable fashion publications, official Shein announcements, and industry reports. Social media platforms and Shein’s own channels can also offer timely information. Being proactive in seeking reliable updates ensures that you stay informed about Shein’s status.

Conclusion

In summary, while rumors about Shein shutting down have generated significant interest, there is no confirmed information about the company’s closure. Shein continues to operate amidst various challenges, and its future will depend on how it addresses these issues. By staying informed and understanding the broader context, you can better navigate the evolving situation with Shein.

FAQs

Is Shein definitely shutting down?

As of now, Shein has not confirmed any plans to shut down. The company continues to operate, and the rumors are speculative.

What are the main reasons behind the rumors?

The rumors are fueled by financial pressures, market competition, and supply chain challenges faced by the company.

How can I stay updated on Shein’s status?

Follow news from reputable sources, Shein’s official channels, and industry reports for the latest updates.

What should customers do if Shein closes?

If Shein closes, customers should seek alternative fashion retailers and monitor any official announcements for guidance on returns or outstanding orders.

Will Shein’s closure affect other fast fashion brands?

Yes, Shein’s closure could impact the fast fashion sector, potentially altering market dynamics and consumer behavior.

Business

How defstartup.org Empowers Startups to Thrive and Innovate

Introduction

In today’s fast-paced economy, startups play a crucial role in driving innovation and economic growth. However, the journey from an idea to a thriving business is fraught with challenges. This is where defstartup.org comes into play, offering indispensable resources, funding opportunities, mentorship, and networking events that empower startups to thrive and innovate. Let’s explore how this platform is transforming the startup ecosystem.

The Mission of defstartup.org

At its core, defstartup.org is dedicated to fostering innovation and entrepreneurship. The platform’s vision is to create a supportive ecosystem where startups can access the resources and guidance they need to succeed. By focusing on innovation-driven ventures, defstartup.org aims to contribute to economic growth, job creation, and industry transformation.

Comprehensive Resources for Startups

Startups need access to a variety of resources to navigate the complexities of business development. defstartup.org provides a wealth of resources, including educational materials, business tools, and industry insights. These resources are designed to help startups at every stage of their journey, from ideation to scaling.

Funding Opportunities

One of the biggest hurdles for startups is securing funding. defstartup.org offers a range of funding options, including grants, loans, and investment opportunities. Success stories abound of startups that have received funding through the platform, demonstrating its effectiveness in helping entrepreneurs turn their visions into reality.

Mentorship and Guidance

Mentorship is a critical component of the startup journey. defstartup.org connects entrepreneurs with experienced mentors who provide invaluable guidance and support. These mentors help startups navigate challenges, make informed decisions, and accelerate their growth.

Networking Events

Networking is essential for startups to build relationships, gain exposure, and find opportunities for collaboration. defstartup.org hosts a variety of networking events, including conferences, workshops, and meetups. These events provide a platform for entrepreneurs to connect with peers, investors, and industry experts.

Empowering Innovation-Driven Ventures

Innovation is the lifeblood of the startup ecosystem. defstartup.org supports a wide range of innovative startups, from tech companies to social enterprises. By providing the necessary resources and support, the platform helps these ventures bring their groundbreaking ideas to market and drive industry transformation.

Economic Growth and Job Creation

Startups are powerful engines of economic growth and job creation. By supporting startups, defstartup.org contributes to the broader economy. The platform’s efforts lead to the creation of new businesses, which in turn generate employment opportunities and stimulate economic activity.

Industry Transformation

The impact of startup innovation on industry transformation cannot be overstated. defstartup.org has supported numerous startups that have disrupted traditional industries and introduced new ways of doing business. These case studies highlight the long-term effects of startup innovation on various sectors.

Navigating Challenges in Entrepreneurship

The path to entrepreneurial success is rarely smooth. Startups face numerous challenges, including funding shortages, market competition, and operational hurdles. defstartup.org provides solutions and support to help startups overcome these challenges, ensuring they have the best chance of success.

Seizing Opportunities for Growth

Growth opportunities abound for startups, but identifying and leveraging them requires strategic planning and execution. defstartup.org helps startups recognize these opportunities and provides the tools and support needed to seize them. This proactive approach is crucial for startups looking to scale and achieve long-term success.

Sustainable Growth in the Competitive Landscape

Sustainable growth is the key to long-term success in the competitive startup landscape. defstartup.org offers strategies and resources to help startups achieve sustainable growth. This includes guidance on business development, market expansion, and operational efficiency.

Global Impact of defstartup.org

The influence of defstartup.org extends beyond national borders. The platform plays a significant role in the global startup ecosystem, supporting entrepreneurs from around the world. As defstartup.org continues to evolve, its impact on the global economy and innovation landscape will only grow.

Conclusion

In conclusion, defstartup.org is a game-changer for startups. By providing essential resources, funding opportunities, mentorship, and networking events, the platform empowers startups to thrive and innovate. Its contributions to economic growth, job creation, and industry transformation are profound, shaping the future of innovation and entrepreneurship on a global scale.

FAQs

How can startups access the resources provided by defstartup.org?

Startups can access resources by registering on the defstartup.org platform and exploring the various tools and materials available.

What types of funding opportunities are available through the platform?

The platform offers a range of funding options, including grants, loans, and investment opportunities tailored to different stages of startup development.

How does defstartup.org select mentors for startups?

Mentors are selected based on their industry experience, expertise, and ability to provide valuable guidance to startups in their respective fields.

What industries benefit the most from the support of defstartup.org?

While supports a wide range of industries, tech startups, social enterprises, and innovation-driven ventures benefit significantly from the platform’s resources and support.

How can entrepreneurs participate in networking events hosted by defstartup.org?

Entrepreneurs can participate in networking events by registering on the platform and signing up for upcoming conferences, workshops, and meetups.

-

Shops1 year ago

Shops1 year agoPublix Pharmacy Hours and Locations

-

Shops1 year ago

Shops1 year agoStaples Store Hours: What Time Does Staples Open And Close?

-

Shops2 years ago

Shops2 years agoWalmart Vision Center Hours

-

Shops1 year ago

Shops1 year agoWalgreen Pharmacy Hours: What Time Does It Open & Close?

-

Business2 years ago

Business2 years agoDesigner Clothing: Making a Statement

-

Entertainment2 years ago

Entertainment2 years agoRoku Red, White, and Blue: Streaming the cultural heart of America

-

Shops1 year ago

Shops1 year agoWalmart Deli Open & Close Hours

-

Shops2 years ago

Shops2 years agoKroger Deli Hours & Store Locations