Business

The Future of Trading: Innovations in Stock Trading Software

Stock trading software forms the critical link between traders and financial markets. Far beyond just executing trades, today’s software provides vital tools for analysis, risk management, and strategy optimization. As technology progresses, trading platforms continue innovating to help users capitalize on market opportunities.

This article explores the current software landscape and the innovations shaping the future of trading technology. We examine the impact of AI, quantum computing, augmented reality, and blockchain on trading practices. Regulatory considerations and the role of emerging technologies like cloud computing are also discussed.

Current Landscape of Stock Trading Software

Contemporary trading software offers robust functionality including

Charting & Technical Analysis – Advanced real-time charting software helps analyze market trends based on historical data. For instance, they use Indicators like the Volume-Weighted Average Price (VWAP) and the Moving Average Convergence/Divergence (MACD) to identify trend reversals and strong breakouts. As a result, traders can easily identify trades with high probability and execute strategies with greater precision.

Trading Strategies & Automation – Advanced trading software has enabled traders to configure and execute trading strategies automatically. As a result, traders can implement all their strategies at a large scale, with precision, and without emotion interfering with decisions.

Order Management – Trading software allows traders to manage orders across instruments efficiently through smart order routing and aggregation. As a result, they can implement strategic trades across fragmented markets without incurring losses.

Portfolio Management – Advanced trading software allows traders to keep a close eye on their investments more easily and in real time. Additionally, they help track risks, returns, asset allocations, and diversification to help traders make informed decisions with confidence.

Innovations Shaping the Future

-

Artificial Intelligence (AI) and Machine Learning (ML)

As we pivot from a broad overview to the cutting-edge forefront, let’s delve into how Artificial Intelligence and Machine Learning are not just reshaping the landscape of stock trading software but redefining the very essence of market analysis and decision-making. With AI and ML, traders are transitioning from navigating through guesswork to steering with precision.

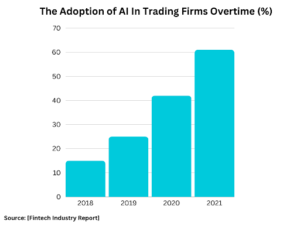

AI is powering a revolution, allowing software to parse huge datasets, detect subtle patterns, and make data-driven predictions using machine learning algorithms. This boosts productivity by 10% as research tasks are automated.

-

Quantum Computing

While AI and ML mark significant leaps forward, the horizon of innovation extends even further with the development of quantum computing. This quantum leap promises to turbocharge data processing capabilities, offering traders and institutions the ability to digest and analyze market data with unprecedented speed and accuracy.

Quantum computing promises to massively accelerate complex computations beyond the capabilities of traditional systems. This could optimize high-frequency trading strategies and portfolio risk analysis.

-

Augmented Reality (AR) for Enhanced Visualization

With the computational revolution underway, the way we interact with and visualize complex market data is also transforming. Augmented Reality (AR) emerges as a powerful tool, turning static charts and numbers into dynamic, immersive experiences. This not only enhances understanding but also empowers traders to make decisions based on insights presented in real-time, three-dimensional space.

By overlaying data visualizations onto real-world environments, AR can provide immersive trading experiences and real-time market insights. Interactive 3D charts could replace flat screens.

Impact of Emerging Technologies on Trading

Beyond the visual and computational advances, the backbone of secure and efficient transactions is being reinforced by Blockchain technology. Its impact extends far beyond cryptocurrencies, offering a new paradigm for transparency, security, and efficiency in stock trading. As we explore this technological cornerstone, it’s clear that blockchain is laying the groundwork for a trustless, decentralized trading ecosystem.

-

Blockchain Technology

At its core, Blockchain facilitates transparent and tamper-proof decentralized ledgers, revolutionizing the way financial transactions are recorded and verified. It removes the need for intermediaries to streamline the trading process and reduce tracing costs while also enhancing security.

-

Big Data Analytics

As datasets grow exponentially, big data analytics uncovers valuable insights from massive data. Traders gain immediate access to a wealth of insights obtained from massive datasets, enabling them to unlock hidden trends and patterns that would otherwise remain unseen. By taking advantage of the power of advanced analytics tools, traders can make fact-based decisions and develop strategies based on evidence rather than guesswork.

-

Robo-Advisors and Personalization

Using AI and machine learning, robo-advisors provide customized investment recommendations and portfolio management based on an investor’s profile and goals. Whether you are a seasoned trader or just starting, robo-advisors will provide invaluable guidance and insights to help youtube around the complexities of the stock market with confidence and clarity.

Regulatory and Security Considerations

Adhering to financial regulations and protecting user data is crucial for building trust in trading platforms. For instance, complying with nationally applicable regulations such as the SEC rules and the Financial Industry Regulatory Authority (FINRA) requirements show traders that the trading platform has legal authority to provide trading services. Compliance with these regulations is also a way for trading platforms to maintain fair, ethical, and transparent markets while protecting the investors.

Additionally, things like encryption and data security ensure that the confidential account data of all traders are safeguarded. This way, clients gain confidence in the financial safeguards and business practices of the trading platform.

The Role of Cloud Computing and IoT in Finance

Cloud computing has made it possible for financial companies to quickly build trading platforms while avoiding the huge costs paid upfront. It also allows them to scale the computing power up and down efficiently as needed. As a result, smaller firms can quickly develop and compete using advanced trading strategies.

On the other hand, the Internet of Things (IoT) provides new real-time data streams like satellite images, giving traders more insights for analysis and modeling. Unfortunately, IoT and alternative data also introduce new cybersecurity and privacy risks all around.

Although technologies like cloud computing and IoT are enabling innovation in finance, they require traders to update their skills and security awareness to fully leverage their benefits.

Conclusion

Innovations in stock trading software are opening new horizons for traders. As emerging technologies transform market analysis, efficiency, and trade execution, adapting to this new paradigm will be key to success. While change brings opportunities, regulatory alignment, and responsible oversight remain essential priorities. By embracing this technology-driven future, financial markets can evolve meaningfully.

Stay ahead of the curve! Subscribe to our newsletter for insights into the latest stock trading software innovations.

Frequently Asked Questions (FAQs)

Q: How is AI used in stock trading software?

A: AI powers automation, predictive analytics, pattern recognition, algorithmic trading strategies, robo-advisors, and other innovations in modern trading software.

Q: Can quantum computing reduce risks in trading?

A: By enabling ultra-fast computations, quantum computing can optimize risk analysis, simulations, and complex portfolio management.

Q: How can AR improve the trading experience?

A: Augmented reality provides interactive 3D visualization of market data for enhanced insights and quicker analysis.

Q: Why is blockchain adoption increasing in finance?**

A: Blockchain enables decentralized, transparent ledgers for secure financial transactions and reduces costs through disintermediation.

Q: What is the benefit of big data analytics in trading?**

A: Uncovering insights from enormous datasets enables backtesting strategies and making informed trading decisions grounded in statistical facts.

Business

Coomersu: The New Era of Commerce and User Engagement

Introduction

In today’s fast-paced and ever-evolving global marketplace, businesses are constantly on the lookout for innovative strategies to stay ahead of the competition. One such groundbreaking concept that has emerged is Coomersu—a dynamic fusion of commerce and user engagement that is reshaping the way companies interact with their customers. This article will explore the essence of Coomersu, its significance, applications, and the myriad benefits it offers in the contemporary business landscape.

What is Coomersu?

Coomersu is a portmanteau of “commerce” and “user,” reflecting a revolutionary approach that emphasizes the integration of user-centric strategies within commercial enterprises. Unlike traditional commerce models that focus primarily on transactions, Coomersu is centered around building robust relationships with customers. It involves creating memorable experiences, fostering loyalty, and driving meaningful interactions.

The Evolution of Commerce

Historical Context of Commerce

Commerce has come a long way from its rudimentary beginnings in bartering and simple trade. Over centuries, it has evolved through various stages—from local marketplaces to global e-commerce platforms. Traditional commerce was heavily transaction-focused, prioritizing the exchange of goods and services over customer experience.

How User Engagement Has Changed Over Time

As technology advanced and consumer expectations grew, businesses began to recognize the importance of engaging with users on a deeper level. The rise of digital platforms and social media has transformed how companies connect with their audience. Today, user engagement is not just about providing a service or product; it’s about creating a holistic experience that resonates with customers on an emotional and personal level.

Key Principles of Coomersu

User-Centric Strategies

At the heart of Coomersu is the principle of user-centricity. This approach involves tailoring strategies to meet the unique needs and preferences of customers. It goes beyond mere customer service to encompass a deeper understanding of user behavior, preferences, and feedback.

Building Relationships vs. Transactions

While traditional commerce focuses on completing transactions, Coomersu prioritizes building lasting relationships with customers. This shift from a transactional to a relational mindset helps businesses create a loyal customer base and drive repeat business.

Creating Memorable Experiences

Coomersu emphasizes the creation of memorable experiences that leave a lasting impression on customers. Whether through personalized interactions, exceptional service, or engaging content, the goal is to make every customer touchpoint meaningful and impactful.

The Benefits of Coomersu

Enhanced Customer Loyalty

One of the primary benefits of adopting Coomersu strategies is the enhancement of customer loyalty. By focusing on user engagement and relationship-building, businesses can foster a sense of loyalty among their customers, leading to higher retention rates and long-term success.

Improved Customer Satisfaction

Coomersu also leads to improved customer satisfaction. When customers feel valued and understood, they are more likely to have positive experiences and provide favorable feedback. This, in turn, enhances the overall reputation of the business.

Increased Brand Advocacy

Satisfied and loyal customers often become brand advocates, promoting the business through word-of-mouth and social media. Coomersu strategies help cultivate this advocacy by ensuring that customers have exceptional experiences worth sharing.

Applications of Coomersu

E-commerce Platforms

In the realm of e-commerce, Coomersu can be applied through personalized shopping experiences, tailored recommendations, and interactive customer support. E-commerce platforms that leverage Coomersu principles can create more engaging and user-friendly environments.

Retail Experiences

For brick-and-mortar stores, Coomersu involves creating immersive and personalized shopping experiences. This can include interactive displays, personalized service, and loyalty programs that enhance the overall in-store experience.

Digital Marketing Strategies

Coomersu principles can also be integrated into digital marketing strategies. This includes personalized content, targeted advertisements, and interactive campaigns that resonate with users and drive engagement.

Implementing Coomersu in Your Business

Steps to Adopt Coomersu Strategies

Adopting Coomersu strategies involves several key steps. Begin by understanding your target audience and gathering insights into their preferences and behaviors. Next, develop user-centric strategies that align with these insights and integrate them into your business operations.

Tools and Technologies for Effective Implementation

To effectively implement Coomersu, businesses can leverage various tools and technologies, such as customer relationship management (CRM) systems, data analytics platforms, and marketing automation tools. These technologies help streamline user engagement efforts and provide valuable insights into customer interactions.

Challenges in Adopting Coomersu

Potential Obstacles

While the benefits of Coomersu are significant, businesses may encounter challenges in its adoption. These challenges can include resistance to change, resource constraints, and difficulties in implementing new technologies.

Solutions to Overcome These Challenges

To overcome these challenges, businesses should focus on gradual implementation, invest in training and development, and seek expert guidance if needed. Building a culture of user-centricity within the organization can also help address resistance and drive successful adoption.

Case Studies of Coomersu in Action

Successful Examples from Various Industries

Several businesses have successfully adopted Coomersu strategies and reaped the rewards. For example, companies in the retail and e-commerce sectors have seen significant improvements in customer loyalty and satisfaction by implementing personalized and engaging experiences.

Lessons Learned and Best Practices

From these case studies, businesses can learn valuable lessons and identify best practices for implementing Coomersu. Key takeaways include the importance of understanding user needs, leveraging technology effectively, and maintaining a focus on relationship-building.

The Future of Coomersu

Emerging Trends and Innovations

The future of Coomersu is likely to be shaped by emerging trends and innovations. Advances in artificial intelligence, machine learning, and data analytics will further enhance user engagement and personalization capabilities.

Predictions for the Evolution of User-Centric Commerce

As Coomersu continues to evolve, we can expect an increased emphasis on hyper-personalization, seamless omnichannel experiences, and greater integration of user feedback into business strategies.

Conclusion

Coomersu represents a transformative shift in commerce, emphasizing the importance of user engagement and relationship-building. By adopting Coomersu principles, businesses can enhance customer loyalty, improve satisfaction, and drive long-term success. As we move forward, embracing this user-centric approach will be crucial for staying competitive in the ever-changing marketplace.

FAQs

What exactly is Coomer’su?

Coomer’su is a concept that combines commerce with user engagement, focusing on building relationships, creating memorable experiences, and fostering customer loyalty.

How can Coomer’su benefit my business?

Coomer’su can benefit your business by enhancing customer loyalty, improving satisfaction, and increasing brand advocacy through user-centric strategies and personalized interactions.

What are the key challenges in implementing Coomer’su?

Key challenges in implementing Coomer’su include resistance to change, resource constraints, and difficulties in integrating new technologies. Addressing these challenges requires gradual implementation, training, and a focus on user-centricity.

Can small businesses adopt Coomer’su strategies?

Yes, small businesses can adopt Coomer’su strategies by focusing on understanding their customers, leveraging affordable tools and technologies, and implementing user-centric practices within their operations.

What are some real-world examples of Coomer’su?

Real-world examples of Coomer’su include personalized shopping experiences in e-commerce, interactive retail displays, and targeted digital marketing campaigns that engage users and enhance their overall experience.

Business

Is Shein Shutting Down? Latest Updates

Introduction

Shein’s Current Status

Recent headlines have sparked curiosity and concern among Shein’s vast customer base. Despite the buzz, it’s crucial to differentiate between speculation and verified information. As of the latest updates, Shein has not officially announced any plans to shut down. The company continues to operate its online platform and retail activities globally. Statements from Shein’s management indicate that while there are challenges, there is no immediate plan for closure.

Reasons Behind the Speculation

Several factors have fueled the speculation about Shein’s potential shutdown:

- Financial Issues: Shein, like many businesses, faces financial pressures, including rising costs and fluctuating revenues. However, financial challenges are common in the retail sector and do not necessarily indicate an impending shutdown.

- Market Competition: The fashion industry is highly competitive, with numerous brands vying for consumer attention. Shein faces stiff competition from both established and emerging brands, which can contribute to market rumors.

- Supply Chain Challenges: Disruptions in the global supply chain have affected many businesses, including Shein. These disruptions can lead to delays and increased costs, fueling speculation about the company’s stability.

Shein’s Business Model

Shein’s success can be attributed to its innovative business model, which focuses on fast fashion. The company is known for its rapid production cycles and extensive inventory, allowing it to offer the latest trends at competitive prices. Shein’s global reach, with its online presence spanning multiple countries, has cemented its position in the fashion industry. Understanding Shein’s business model provides context for the challenges it faces and the speculations surrounding its future.

Consumer Reactions

Consumers play a vital role in Shein’s brand image and success. The recent rumors of a potential shutdown have led to mixed reactions among Shein’s customers. While some are concerned about losing access to their favorite fashion pieces, others are skeptical of the rumors, viewing them as part of the industry’s natural ups and downs. The impact on consumers also includes potential shifts in shopping habits and brand loyalty.

Industry Experts’ Opinions

Fashion industry experts and analysts offer various perspectives on Shein’s situation. Some believe that Shein’s strong market position and innovative strategies will help it navigate current challenges. Others are cautious, noting that the fashion industry’s volatility can be unpredictable. Expert opinions provide valuable insights into the possible scenarios for Shein’s future, highlighting both opportunities and risks.

Impact on the Fashion Industry

The potential closure of a major player like Shein could have broader implications for the fashion industry. Shein’s departure might affect fast fashion trends, pricing dynamics, and consumer behavior. The industry could see shifts in market share, with other brands potentially filling the void left by Shein. Understanding these potential impacts helps in grasping the broader significance of the current rumors.

What’s Next for Shein?

While the future of Shein remains uncertain, several scenarios could play out. The company might adapt to challenges by restructuring its business model, exploring new markets, or enhancing its supply chain. Monitoring Shein’s strategic moves and official announcements will be crucial in understanding its trajectory. Staying informed about these developments can provide insights into the brand’s future.

How to Stay Informed

To keep up with the latest updates on Shein, it’s essential to rely on credible sources. Follow news from reputable fashion publications, official Shein announcements, and industry reports. Social media platforms and Shein’s own channels can also offer timely information. Being proactive in seeking reliable updates ensures that you stay informed about Shein’s status.

Conclusion

In summary, while rumors about Shein shutting down have generated significant interest, there is no confirmed information about the company’s closure. Shein continues to operate amidst various challenges, and its future will depend on how it addresses these issues. By staying informed and understanding the broader context, you can better navigate the evolving situation with Shein.

FAQs

Is Shein definitely shutting down?

As of now, Shein has not confirmed any plans to shut down. The company continues to operate, and the rumors are speculative.

What are the main reasons behind the rumors?

The rumors are fueled by financial pressures, market competition, and supply chain challenges faced by the company.

How can I stay updated on Shein’s status?

Follow news from reputable sources, Shein’s official channels, and industry reports for the latest updates.

What should customers do if Shein closes?

If Shein closes, customers should seek alternative fashion retailers and monitor any official announcements for guidance on returns or outstanding orders.

Will Shein’s closure affect other fast fashion brands?

Yes, Shein’s closure could impact the fast fashion sector, potentially altering market dynamics and consumer behavior.

Business

How defstartup.org Empowers Startups to Thrive and Innovate

Introduction

In today’s fast-paced economy, startups play a crucial role in driving innovation and economic growth. However, the journey from an idea to a thriving business is fraught with challenges. This is where defstartup.org comes into play, offering indispensable resources, funding opportunities, mentorship, and networking events that empower startups to thrive and innovate. Let’s explore how this platform is transforming the startup ecosystem.

The Mission of defstartup.org

At its core, defstartup.org is dedicated to fostering innovation and entrepreneurship. The platform’s vision is to create a supportive ecosystem where startups can access the resources and guidance they need to succeed. By focusing on innovation-driven ventures, defstartup.org aims to contribute to economic growth, job creation, and industry transformation.

Comprehensive Resources for Startups

Startups need access to a variety of resources to navigate the complexities of business development. defstartup.org provides a wealth of resources, including educational materials, business tools, and industry insights. These resources are designed to help startups at every stage of their journey, from ideation to scaling.

Funding Opportunities

One of the biggest hurdles for startups is securing funding. defstartup.org offers a range of funding options, including grants, loans, and investment opportunities. Success stories abound of startups that have received funding through the platform, demonstrating its effectiveness in helping entrepreneurs turn their visions into reality.

Mentorship and Guidance

Mentorship is a critical component of the startup journey. defstartup.org connects entrepreneurs with experienced mentors who provide invaluable guidance and support. These mentors help startups navigate challenges, make informed decisions, and accelerate their growth.

Networking Events

Networking is essential for startups to build relationships, gain exposure, and find opportunities for collaboration. defstartup.org hosts a variety of networking events, including conferences, workshops, and meetups. These events provide a platform for entrepreneurs to connect with peers, investors, and industry experts.

Empowering Innovation-Driven Ventures

Innovation is the lifeblood of the startup ecosystem. defstartup.org supports a wide range of innovative startups, from tech companies to social enterprises. By providing the necessary resources and support, the platform helps these ventures bring their groundbreaking ideas to market and drive industry transformation.

Economic Growth and Job Creation

Startups are powerful engines of economic growth and job creation. By supporting startups, defstartup.org contributes to the broader economy. The platform’s efforts lead to the creation of new businesses, which in turn generate employment opportunities and stimulate economic activity.

Industry Transformation

The impact of startup innovation on industry transformation cannot be overstated. defstartup.org has supported numerous startups that have disrupted traditional industries and introduced new ways of doing business. These case studies highlight the long-term effects of startup innovation on various sectors.

Navigating Challenges in Entrepreneurship

The path to entrepreneurial success is rarely smooth. Startups face numerous challenges, including funding shortages, market competition, and operational hurdles. defstartup.org provides solutions and support to help startups overcome these challenges, ensuring they have the best chance of success.

Seizing Opportunities for Growth

Growth opportunities abound for startups, but identifying and leveraging them requires strategic planning and execution. defstartup.org helps startups recognize these opportunities and provides the tools and support needed to seize them. This proactive approach is crucial for startups looking to scale and achieve long-term success.

Sustainable Growth in the Competitive Landscape

Sustainable growth is the key to long-term success in the competitive startup landscape. defstartup.org offers strategies and resources to help startups achieve sustainable growth. This includes guidance on business development, market expansion, and operational efficiency.

Global Impact of defstartup.org

The influence of defstartup.org extends beyond national borders. The platform plays a significant role in the global startup ecosystem, supporting entrepreneurs from around the world. As defstartup.org continues to evolve, its impact on the global economy and innovation landscape will only grow.

Conclusion

In conclusion, defstartup.org is a game-changer for startups. By providing essential resources, funding opportunities, mentorship, and networking events, the platform empowers startups to thrive and innovate. Its contributions to economic growth, job creation, and industry transformation are profound, shaping the future of innovation and entrepreneurship on a global scale.

FAQs

How can startups access the resources provided by defstartup.org?

Startups can access resources by registering on the defstartup.org platform and exploring the various tools and materials available.

What types of funding opportunities are available through the platform?

The platform offers a range of funding options, including grants, loans, and investment opportunities tailored to different stages of startup development.

How does defstartup.org select mentors for startups?

Mentors are selected based on their industry experience, expertise, and ability to provide valuable guidance to startups in their respective fields.

What industries benefit the most from the support of defstartup.org?

While supports a wide range of industries, tech startups, social enterprises, and innovation-driven ventures benefit significantly from the platform’s resources and support.

How can entrepreneurs participate in networking events hosted by defstartup.org?

Entrepreneurs can participate in networking events by registering on the platform and signing up for upcoming conferences, workshops, and meetups.

-

Shops1 year ago

Shops1 year agoPublix Pharmacy Hours and Locations

-

Shops1 year ago

Shops1 year agoStaples Store Hours: What Time Does Staples Open And Close?

-

Shops2 years ago

Shops2 years agoWalmart Vision Center Hours

-

Shops1 year ago

Shops1 year agoWalgreen Pharmacy Hours: What Time Does It Open & Close?

-

Business2 years ago

Business2 years agoDesigner Clothing: Making a Statement

-

Entertainment2 years ago

Entertainment2 years agoRoku Red, White, and Blue: Streaming the cultural heart of America

-

Shops1 year ago

Shops1 year agoWalmart Deli Open & Close Hours

-

Shops2 years ago

Shops2 years agoKroger Deli Hours & Store Locations