Real Estate

Distressed Assets in Real Estate: Strategies for Maximizing ROI

Investing in distressed real estate assets can be a profitable venture when done correctly. Although these properties often come at a lower price due to their conditions or the financial status of their owners, they can lead to significant returns on investment (ROI) with the right strategies.

In this article, we’ll discuss key tactics that investors can employ to maximize their ROI when dealing with distressed assets.

Rehabilitation and Flip

One way to make good money from distressed real estate is fixing and flipping. This means you buy a property that’s not in great shape at a low price, spend some money and effort to fix it up, and then sell it for a lot more.

You have to be smart about picking the right house, knowing how much repairs will cost, and not spending too much so you still profit when you sell. It’s like giving a makeover to an old house and then finding someone who’ll pay you because it looks amazing now.

Buy and Hold

The “Buy and Hold” strategy is about purchasing distress property for sale and keeping them over time. Instead of fixing them up quickly to sell, you hold onto them. This works well when property values are expected to go up.

Over time, you might rent out the property to make money every month. Later, when its value is higher, you can sell for a big profit. This approach needs patience but can pay off.

Wholesaling

Wholesaling is like being the middleman in real estate deals. You find a cheap, distressed homes property and get it under contract. Then, you find someone who wants to buy it and sell them the contract for more than you’re paying.

You don’t buy the house or do any fixes. Your job is to find deals and buyers and then connect them. It’s a quick way to make cash without needing a lot of money to start. But you have to be good at finding deals and talking to people to make it work.

Seller Financing

Seller financing is when the seller of the property acts like a bank. Instead of getting a loan from a bank to buy the house, the seller gives you the loan. This is often used in deals with distressed properties because it can be easier and faster than traditional loans. You and the seller agree on the price, interest rate, and how long you’ll take to pay them back.

This way helps people buy homes when banks might say no. Also, if you’re looking to sell fast and hassle-free, consider a fast cash offer from reputable buyers. It’s a smooth path that can work well for both the buyer and the seller, especially in quick-sale situations.

Creative Leasing Options

Creative Leasing Options are super cool and easy-to-understand ways to make money in real estate, even if you don’t want to buy a house right away. Imagine you’re playing a game where you can control a house like you’re the owner, but you didn’t buy it.

One way is called “Lease with an Option to Purchase.” This is like renting a house, but with a special promise that says you can buy the house later if you want to, at a price you all agree on now.

It’s awesome because you get to live in the house and decide later if you want to keep it forever. Plus, some of the rent money you pay might even go towards buying the house if you decide to do it!

Market Research and Analysis

Before jumping into any investment in distressed real estate, it’s crucial to conduct thorough market research and analysis. Understanding the local real estate market trends, property values, and the potential for growth or decline can significantly impact your investment decision.

Identifying factors such as employment rates, future development plans in the area, and average rental prices can help you make informed choices and target the right properties.

Building a Professional Network

Success in the real estate market, especially when dealing with distressed properties, often depends on the network you build. Connecting with real estate agents, contractors, property managers, and other investors can provide valuable insights and opportunities.

A strong network can also offer recommendations for reliable service providers and may alert you to deals before they hit the open market.

Understanding Legal and Tax Implications

Investing in distressed real estate comes with its set of legal and tax considerations. It’s essential to be aware of the foreclosure process, rights of redemption, and any liens against the property.

Additionally, understand the tax implications of your investment strategy, whether it’s flipping or holding onto a property. Consulting with legal and tax professionals can prevent unexpected setbacks and ensure your investment complies with all regulations.

Risk Management Strategies

While investing in distressed properties can offer high returns, it’s not without risk. Developing a risk management plan is vital. Consider diversifying your investment portfolio to spread risk, setting aside a budget for unforeseen expenses, and conducting due diligence on every property before purchasing.

Having contingency plans for scenarios where the market takes an unexpected turn can safeguard your investments.

Exit Strategy Planning

Planning your exit strategy is like planning your route before a trip. It means thinking about how you’re going to sell or leave your investment before you even buy it. You should have a few plans, in case things change. For example, you might plan to fix up a house and sell it.

But if the market drops, you could rent it out instead. Or maybe you’ll sell it to another investor. Having a clear exit plan helps you stay focused and can make you money. It’s like having a backup plan that keeps you safe and helps you win in the end.

Learn All About Distressed Assets

In conclusion, rocking distressed assets real estate isn’t for the faint of heart, but it’s a goldmine if you play your cards right. Remember, it’s all ’bout smart moves like fixing and flipping, playing the long game, finding those middleman sweet spots, or getting creative with deals.

Do your homework, build a killer squad, and always have an ace up your sleeve. And hey, when in doubt, chat up a pro. Happy house hunting!

Did you find this article helpful? Check out the rest of our blog.

Real Estate

Finding Apartments That Accept Evictions: Your Ultimate Guide

Introduction

Finding an apartment with a past eviction on your record can indeed be challenging, but it’s far from impossible. This detailed guide is designed to help you navigate the often tricky rental market and find apartments that accept evictions. With the right approach and strategies, you can successfully secure a rental property that meets your needs despite a previous eviction. Whether you’re dealing with a single eviction or a more complex rental history, this guide provides practical tips and resources to improve your chances of finding a suitable apartment and starting anew.

Understanding Your Rental History

Review Your Rental History

Before starting your search for a new apartment, it’s crucial to understand your rental history thoroughly. Check your records for any evictions or negative marks and gather all relevant documentation. This will help you be prepared for questions from potential landlords.

Assess Your Credit Report

Your credit report often includes rental history and eviction details. Obtain a copy from a major credit bureau and review it for accuracy. Correct any errors before applying for new rentals.

Research Second-Chance Apartments

What Are Second-Chance Apartments?

Second-chance apartments are rental properties managed by companies or landlords who are more lenient with applicants who have past evictions or poor credit histories. These apartments can offer a fresh start if you’re having trouble finding a place due to your past rental issues.

Finding Second-Chance Apartments

Search online for property management companies or rental agencies that specialize in second-chance housing. Websites and forums dedicated to these types of rentals can also be valuable resources.

Be Honest and Transparent

Disclose Your Eviction

When applying for an apartment, be upfront about your past eviction. Honesty is crucial in building trust with potential landlords and demonstrating that you are a responsible tenant.

Explain Your Situation

Prepare a brief explanation of the circumstances surrounding your eviction. Highlight any steps you’ve taken to rectify the situation and improve your financial stability.

Prepare a Strong Rental Application

Provide References

Strong references from previous landlords or employers can significantly bolster your application. Ask for letters of recommendation that speak to your reliability and character.

Show Proof of Income

Landlords want to ensure that you can afford the rent. Provide recent pay stubs, bank statements, or other proof of income to demonstrate your ability to make timely rent payments.

Write a Cover Letter

A well-written cover letter can make a difference. Explain your situation, express your commitment to being a good tenant, and provide context for your past eviction.

Offer a Larger Deposit

Why a Larger Deposit Helps

Offering a larger security deposit can provide landlords with added reassurance. It shows your commitment to maintaining the property and can offset their concerns about your past eviction.

Negotiating the Deposit

If a larger deposit is not feasible, negotiate with the landlord to find a compromise. Propose a smaller deposit with a higher rent payment or additional guarantees.

Consider Co-Signers

How a Co-Signer Can Help

A co-signer with a strong rental history and good credit can strengthen your application. This person agrees to take responsibility for the rent if you default, reducing the landlord’s risk.

Finding a Co-Signer

Choose someone who is willing to take on this responsibility and who has a solid financial background. Ensure they understand the commitment involved.

Look for Private Landlords

Benefits of Private Landlords

Private landlords often have more flexibility than large property management companies. They may be willing to consider your application on a case-by-case basis, especially if you present a compelling case.

How to Find Private Landlords

Use local classifieds, community boards, and networking to find private landlords who may be open to renting to individuals with past evictions.

Utilize Online Resources

Online Platforms for Finding Rentals

Several online platforms cater to individuals with past evictions. Websites like Craigslist, Facebook Marketplace, and specialized rental platforms can offer leads on suitable rentals.

Joining Online Forums and Groups

Engage in online forums and social media groups focused on rental housing. These communities can provide valuable insights and potential leads on available apartments.

Be Persistent and Patient

The Importance of Persistence

Finding an apartment with an eviction on your record may take time. Stay persistent, continue applying, and keep improving your application.

Managing Rejections

Rejections are a part of the process. Use them as learning opportunities and refine your approach based on feedback.

Avoiding Scams

Identifying Rental Scams

Be cautious of companies or landlords that promise guaranteed approval regardless of your eviction history but require upfront fees. Research these entities thoroughly before making any payments.

Protecting Yourself

Verify the legitimacy of rental services and landlords. Use trusted sources and avoid making payments until you are confident in the legitimacy of the offer.

Conclusion

Finding an apartment with a past eviction can be challenging, but with the right approach and persistence, it is possible. By understanding your rental history, researching second-chance apartments, being honest in your applications, and utilizing various resources, you can improve your chances of securing a rental that meets your needs.

FAQs

What are apartments that accept evictions?

Apartments that accept evictions are rental properties where landlords or property managers are willing to overlook past eviction records when considering a rental application. These apartments are often managed by second-chance rental companies or private landlords who offer more flexibility in their rental criteria.

Can I get an apartment with an eviction if I have a good income?

Yes, having a good income can help, but it might not be sufficient on its own. It’s crucial to address the eviction openly and provide strong references and proof of income.

Are there specific cities where finding an Apartments That Accept Evictions is easier?

Some cities have more lenient rental markets and more options for second-chance housing. Research local rental laws and resources in the area where you wish to move.

What should I include in a cover letter for my rental application?

Your cover letter should explain the circumstances of your eviction, highlight any positive changes you’ve made since then, and express your commitment to being a reliable tenant.

How can I avoid rental scams when searching for apartments?

Research potential landlords and rental services thoroughly. Be wary of companies that ask for large upfront fees and always verify the legitimacy of the rental offers before making any payments.

Real Estate

Top Real Estate Social Networks: Connect and Collaborate in 2024

Introduction

In today’s digital age, social networks are not just for connecting with friends and family; they are essential tools for professionals across various industries. For those in real estate, leveraging social networks can open up new opportunities, foster collaborations, and drive business growth. This article delves into the top real estate social networks you should consider in 2024 to enhance your networking and collaboration efforts.

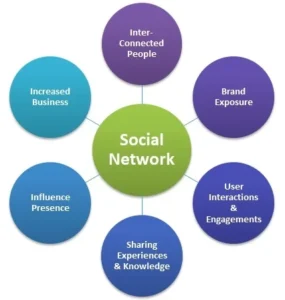

Why Real Estate Professionals Need Social Networks

Building Professional Relationships

Social networks provide a platform for real estate professionals to connect with peers, clients, and industry leaders. These connections can lead to valuable partnerships and referrals.

Expanding Market Reach

Through social networks, real estate agents can reach a broader audience, showcasing their listings and expertise to potential buyers and investors worldwide.

Access to Market Insights

Social networks offer real-time updates and discussions about market trends, which can be invaluable for staying ahead in the competitive real estate industry.

Top Real Estate Social Networks in 2024

Overview

LinkedIn remains a leading platform for professional networking. It’s especially valuable for real estate professionals looking to connect with other industry experts and potential clients.

Features for Real Estate Professionals

- Networking Opportunities: Connect with industry leaders, potential clients, and partners.

- Content Sharing: Post updates about market trends, listings, and professional achievements.

- Groups and Forums: Join real estate groups to participate in discussions and share insights.

Overview

Facebook continues to be a powerful tool for real estate marketing and networking. With its vast user base, it provides multiple ways to engage with potential clients.

Features for Real Estate Professionals

- Business Pages: Create a professional page to showcase listings, client testimonials, and market updates.

- Groups: Join local real estate groups or create your own to engage with the community.

- Advertising: Use targeted ads to reach specific demographics and boost property visibility.

Overview

Instagram is perfect for visual storytelling and showcasing properties. Its image-centric platform helps real estate professionals highlight their listings effectively.

Features for Real Estate Professionals

- Visual Content: Share high-quality photos and videos of properties.

- Stories and Reels: Use these features to provide virtual tours and updates.

- Hashtags: Utilize relevant hashtags to increase the visibility of your posts.

Overview

Twitter offers real-time updates and a platform for engaging in industry conversations. It’s ideal for sharing news, insights, and quick updates.

Features for Real Estate Professionals

- Quick Updates: Post market news, property updates, and industry insights.

- Networking: Engage with industry hashtags and participate in real estate discussions.

- Direct Messaging: Connect with potential clients and partners through private messages.

BiggerPockets

Overview

BiggerPockets is a specialized network focused on real estate investing. It provides tools and resources tailored to real estate investors.

Features for Real Estate Professionals

- Forums: Participate in discussions about real estate investing and market trends.

- Tools and Calculators: Use tools for property analysis and investment planning.

- Networking: Connect with other investors and real estate professionals.

Real Estate Forums

Overview

Dedicated real estate forums offer in-depth discussions and resources for professionals in the industry. These forums are often niche and cater to specific aspects of real estate.

Features for Real Estate Professionals

- Industry Insights: Engage in discussions about market trends, best practices, and investment strategies.

- Expert Advice: Seek guidance from experienced professionals and industry experts.

- Community Support: Join a community of like-minded professionals for support and advice.

How to Maximize Your Presence on Real Estate Social Networks

Create a Professional Profile

Ensure your profiles on these networks are complete and professional. Include high-quality photos, detailed bios, and links to your website or portfolio.

Engage Regularly

Consistent engagement is key to building relationships. Share valuable content, participate in discussions, and respond to comments and messages.

Leverage Content Marketing

Use social networks to share informative and engaging content. This could include blog posts, market analyses, and property showcases.

Utilize Networking Features

Take advantage of networking features such as groups, forums, and direct messaging to connect with potential clients and industry peers.

Monitor and Analyze Performance

Use analytics tools provided by social networks to monitor your performance. Track engagement, reach, and other metrics to refine your strategy.

Conclusion

Social networks have become indispensable tools for real estate professionals in 2024. By leveraging platforms like LinkedIn, Facebook, Instagram, Twitter, BiggerPockets, and dedicated real estate forums, you can expand your reach, build valuable connections, and stay ahead in the competitive real estate market. Embrace these networks to enhance your professional presence and drive success in your real estate career.

FAQs

How can I use LinkedIn for real estate networking?

LinkedIn allows you to connect with industry professionals, join real estate groups, and share updates about your business and market trends.

What are the benefits of using Instagram for real estate marketing?

Instagram is ideal for showcasing property photos, sharing virtual tours through Stories and Reels, and increasing visibility with relevant hashtags.

How can Facebook Ads benefit my real estate business?

Facebook Ads allow you to target specific demographics, boosting the visibility of your property listings and reaching potential clients effectively.

What type of content should I post on Twitter for real estate?

Share quick updates, market news, and engage in industry conversations. Use Twitter to stay informed and connect with other professionals.

What is BiggerPockets and how can it help real estate investors?

BiggerPockets is a network focused on real estate investing, offering forums, tools, and resources for property analysis and investment planning.

Real Estate

10 Common Mistakes First-Time Homebuyers Should Avoid

Purchasing your inaugural home marks a thrilling milestone, yet it can also present a labyrinth of challenges fraught with potential missteps. From financial oversights to disregarding critical details, novice homebuyers frequently encounter errors that can yield enduring repercussions. To steer you through the process of acquiring your first property successfully, here are 10 prevalent blunders to sidestep, accompanied by thorough explanations to empower you to make well-informed decisions:

1. Insufficient Grasp of Your Financial Limits

Among the most pivotal missteps first-time homebuyers commit is inadequately comprehending their financial boundaries. Before initiating your search for a new home, ensure you allocate sufficient time to thoroughly assess your financial situation.

Delve into not only your existing income but also potential future changes, such as career advancements or expanding familial needs. Factor in all expenditures, encompassing utilities, insurance, and maintenance outlays, to ascertain the extent to which you can comfortably allocate funds toward a mortgage each month without overextending your resources.

2. Overlooking Mortgage Pre-Approval

Obtaining pre-approval for a mortgage is an essential prerequisite before initiating property exploration. Pre-approval provides a clear assessment of your borrowing capacity and demonstrates to sellers your sincere commitment as a potential buyer. Moreover, it streamlines your search by focusing solely on properties within your financial parameters, thus saving both time and frustration.

Failure to undertake this initial step can result in disappointment if you discover your dream home but encounter obstacles securing financing or become emotionally attached to a property beyond your financial reach. Securing an advantageous first-time buyer mortgage is imperative for novice homebuyers to establish a sturdy financial groundwork as they embark on their journey toward homeownership.

3. Disregarding Additional Financial Obligations

Beyond the sticker price of the dwelling, a myriad of supplementary costs demands consideration. Closing fees, property taxes, homeowners association dues (if pertinent), and ongoing upkeep charges can accrue swiftly.

Failure to account for these outlays may strain your financial stability and leave you ill-equipped to confront the genuine expenses entailed by homeownership. Construct a comprehensive budget encompassing all potential expenditures to ensure you are financially equipped to navigate the terrain of homeownership.

4. Fixating Solely on the Purchase Price

While the purchase amount holds significance, it should not monopolize your attention when contemplating a home purchase. Refrain from neglecting other pivotal factors such as neighborhood ambiance, educational district quality, proximity to amenities, and prospective resale value.

Opting for a locale and property features that resonate with your long-term aspirations can significantly enhance your contentment with your chosen domicile. Factor in your lifestyle preferences and future aspirations when assessing prospective properties to ensure they align harmoniously with your needs, transcending mere financial considerations.

5. Neglecting Comprehensive Home Inspections

A meticulous home inspection constitutes an imperative step in uncovering latent issues or potential deficiencies within the property. Neglecting this crucial step exposes you to unexpected financial setbacks in the future.

Investing in a professional home inspection serves to flag any potential concerns prior to finalizing the purchase. Despite initial costs, this prudent measure can yield substantial savings by preempting costly repairs or renovations in the future.

6. Overlooking Anticipated Future Needs

When contemplating your inaugural home purchase, it is imperative to factor in prospective future requirements and lifestyle modifications. Do you envision expanding your family? Contemplating a home-based career? Anticipating such developments and selecting a domicile conducive to accommodating your evolving circumstances can obviate the necessity for relocation in the foreseeable future.

Factors such as property size, bedroom and bathroom count, and potential for expansion or renovation should be scrutinized to ensure your chosen abode remains commensurate with your evolving requisites in the years ahead.

7. Underestimating the Magnitude of Maintenance Expenses

Homeownership entails an array of ongoing maintenance and repair obligations that may be unfamiliar to erstwhile renters. From routine upkeep to unforeseen repairs, it is imperative to earmark resources for these difficulties to avert financial strain. Allocating a segment of your budget toward maintenance and contingency reserves ensures you are equipped to preserve your dwelling in optimal condition.

8. Neglecting Due Diligence on Mortgage Alternatives

A common oversight among novice homebuyers is accepting the initial mortgage offer sans exploration of alternative options. Engage in thorough research of diverse mortgage products, interest rates, and terms to pinpoint the optimal fit for your financial profile.

Consulting with a mortgage broker can furnish invaluable guidance in navigating the labyrinthine intricacies of the lending realm and identifying prospective savings or incentives. By conducting a comprehensive survey of mortgage options, you stand poised to realize potential savings amounting to thousands of dollars over the mortgage’s duration.

9. Making Emotionally Driven Decisions

Procuring a home represents a monumental financial decision, often imbued with emotional undertones. During the homebuying odyssey, guard against allowing emotions to cloud your judgment.

Adhere steadfastly to your priorities, financial objectives, and the enduring implications of your choice, eschewing impulsive impulses engendered by transient emotions. Exercise judicious discretion in meticulously evaluating each property, scrutinizing its attributes and drawbacks with objectivity.

10. Forfeiting Professional Real Estate Guidance

While it is conceivable to procure a home sans real estate agent intervention, the expertise and advocacy of a seasoned professional can prove invaluable, particularly for neophyte buyers.

A proficient agent serves as a stalwart ally, adeptly shepherding you through the labyrinth of the homebuying continuum. They can adroitly negotiate on your behalf, proffer astute insights into the local market dynamics, and navigate potential pitfalls with dexterity.

Conclusion

Acquiring your first home is an exciting yet complex journey that requires careful planning and strategic decision-making. By avoiding common pitfalls and seeking guidance when needed, you can navigate the process successfully and set yourself up for long-term financial stability. Stay informed, be patient, and prioritize your financial well-being as you get on this significant milestone. With diligence and attention to detail, you can find the perfect home for you and your family while avoiding costly mistakes.

-

Fashion2 years ago

Fashion2 years agoExploring Purenudism: Embracing Body Positivity and Freedom

-

Shops1 year ago

Shops1 year agoStaples Store Hours: What Time Does Staples Open And Close?

-

Shops2 years ago

Shops2 years agoWalmart Vision Center Hours

-

Shops1 year ago

Shops1 year agoWalgreen Pharmacy Hours: What Time Does It Open & Close?

-

Shops1 year ago

Shops1 year agoPublix Pharmacy Hours and Locations

-

Entertainment2 years ago

Entertainment2 years agoThothub.lol: The Digital Realm of Entertainment

-

Business2 years ago

Business2 years agoDesigner Clothing: Making a Statement

-

Shops1 year ago

Shops1 year agoWalmart Deli Open & Close Hours